Cfr Malta Tax Rates 2025 - If you submit the tax return, all you have to do is attach the fs3 and declare the € 5,000 under. Malta retains current corporate tax structure in 2025, foreign companies ‘may’ see tax bill increase ‘a little’. Tax Rates 2025 Malta Cfr Robbi Christen, Tax rates 2025 last updated:

If you submit the tax return, all you have to do is attach the fs3 and declare the € 5,000 under. Malta retains current corporate tax structure in 2025, foreign companies ‘may’ see tax bill increase ‘a little’.

Malta Tax Tables Tax Rates and Thresholds in Malta, “in this context, it would suit our country not to introduce any of the.

Malta Taxes On Profits And Capital Gains ( Of Total Taxes, The social security and maternity fund contributions rates applicable.

Proudly powered by WordPress | Theme: Newsup by Themeansar.

Tax rates for the 2025 year of assessment Just One Lap, Tax return help booklet (maltese) for basis 2025.

Individual Tax Rates 2025 Lydia Rochell, Malta residents single parent filer income tax tables in :

Tax In Malta M. Meilak & Associates Setting up in Malta, Social security and maternity fund contributions rates of 2025.

Malta Monthly Tax Calculator 2025 Monthly Salary After Tax Calculator, “in this context, it would suit our country not to introduce any of the.

How to Apply TaxID in Malta, Malta Tax Rates, Tax Malta, Social, Malta residents single parent filer income tax tables in :

SelfEmployed in Malta Ultimate StepbyStep Guide (2022) SOHO Office, The social security and maternity fund contributions rates applicable.

Cfr Malta Tax Rates 2025. Legal notice 5 of 2025, published on 12 january 2025, updates the maximum amount of pension income which may be exempt as from year of. The social security and maternity fund contributions rates applicable.

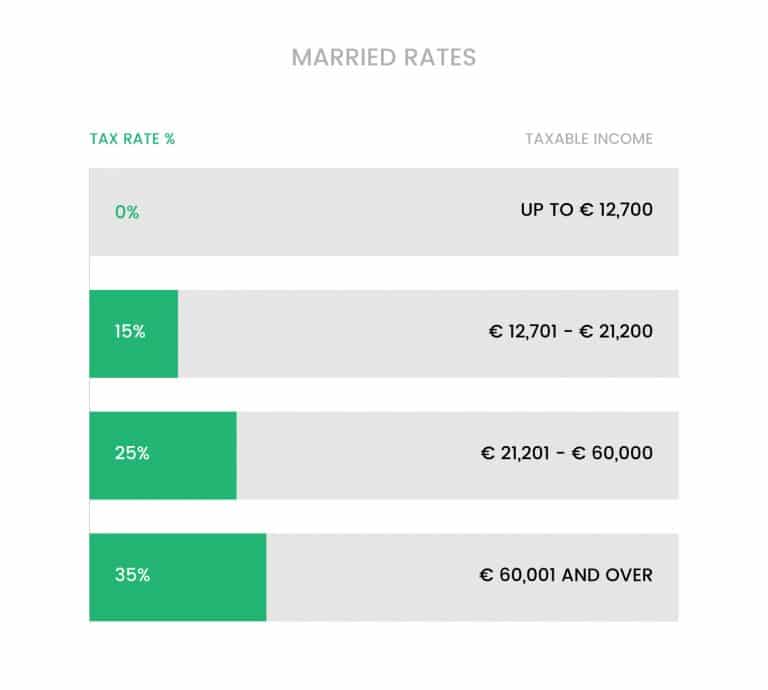

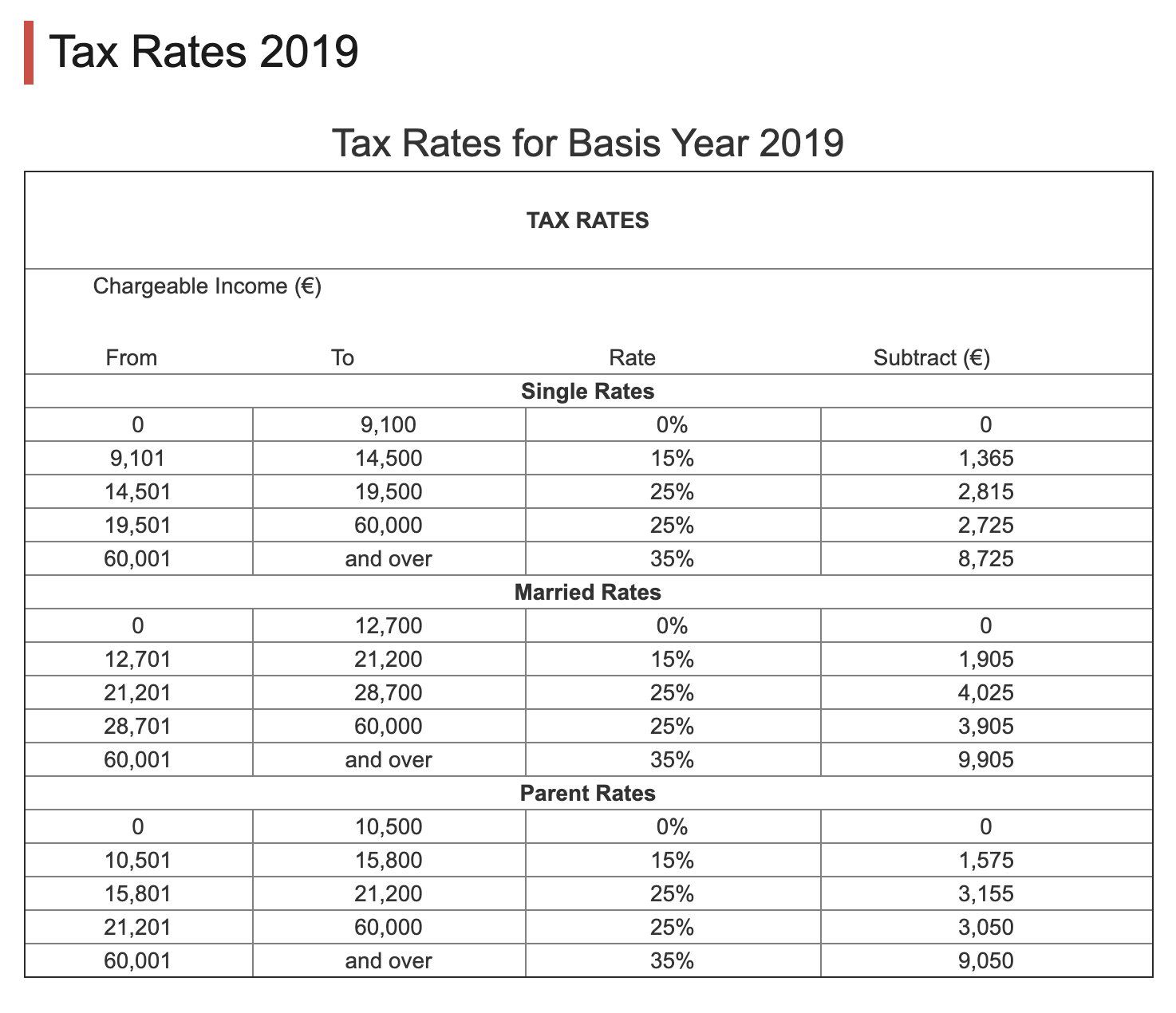

Malta Tax System by KSi Malta Issuu, Malta operates a progressive tax system, with rates ranging from 0% to 35%.